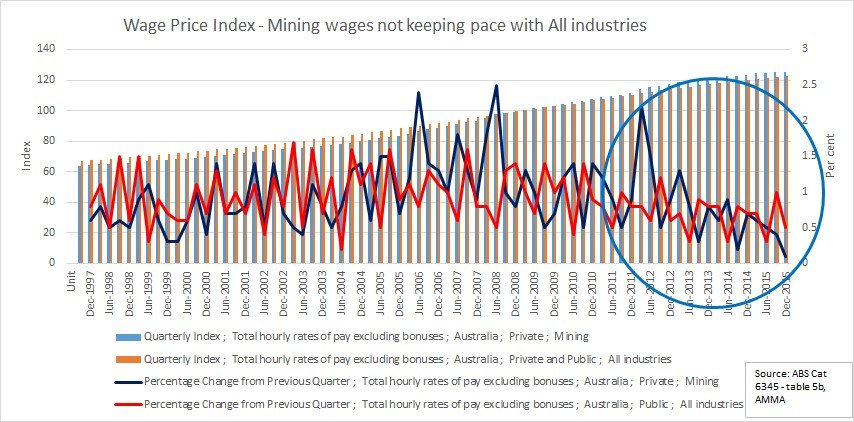

THE ABS’s December quarter wage price index results released last week indicate resource industry wage growth is continuing to subside to more sustainable levels.

Looking at the raw data for Australia as a whole, the wage price index rose by 0.4% in the December quarter 2015, completing a 2% growth over the year. When considering trend figures (which takes long term movement and other variables into account) the quarterly increase was slightly higher at 0.5% and 2.2% over the year.

From a resource industry perspective (collectively referred to by the ABS as ‘mining’), wages rose by 0.1% in the December quarter, and annually by 1.6%. This followed a 0.5% rise in the September quarter.

The blue line in the below graph shows the downward trajectory of mining wage price growth, particularly from June 2012 which was a peak time for resources investment activity, labour demand and skills shortages.

Considering current suppressed commodity prices and reduced spending in the resource industry, AREEA expects the wage price index to remain at more sustainable growth levels for some time.

ABS confirms fall in exploration spend

Spending on mineral and petroleum exploration also fell in the quarter to December 2015, according to the ABS.

In original terms, mineral exploration expenditure fell 3.0% ($12.0 million) to $382m. Exploration on areas of new deposits fell 7.8% ($9.0m) and expenditure on areas of existing deposits fell 1.1% ($3.0m).

In original terms, the largest decrease by minerals sought came from expenditure on iron ore (down 9.4%, $7.7m). Another large decrease came from expenditure on uranium (down 30.5%, $4.7m).

More detailed analysis on the ABS mineral exploration expenditure numbers will be provided in the next edition of the AREEA Resource Industry Market Outlook, which will be distributed to AREEA members in March.

For more information on the data discussed in this article, or other market analysis, please contact AREEA’s senior industry policy adviser Tristan Menalda on (03) 9614 4777.