THIS WEEK the Australian Bureau of Statistics released data on annual industry multi-factor productivity (MFP) levels.

THIS WEEK the Australian Bureau of Statistics released data on annual industry multi-factor productivity (MFP) levels.

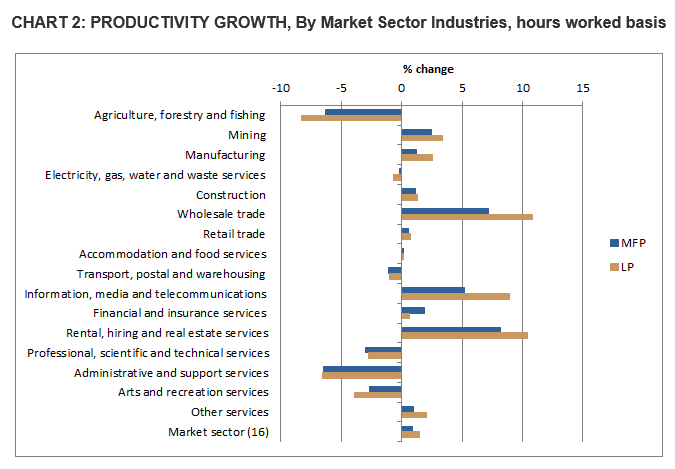

While comparatively down on last year, MFP for mining grew 2.9% in 2015-16 compared to the market sector average of 0.9%.

Mining MFP growth according to the ABS is “mainly due to strong output growth of 6.2% and weaker capital services growth (4.0%), reflecting the tapering off of capital expenditure”.

The ABS also explained that “significant MFP growth in mining in the last two years has signalled a transition from an investment phase into a production phase”.

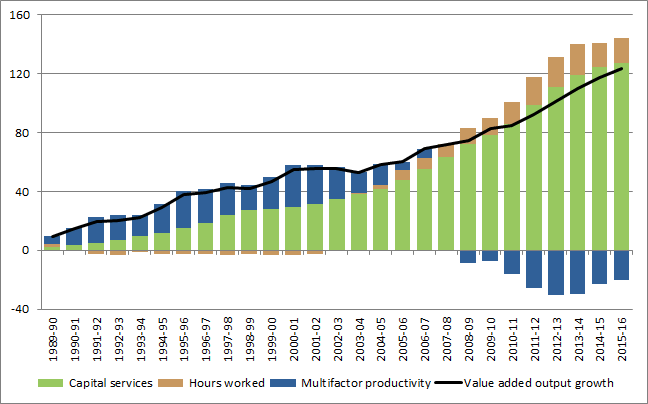

The graph to the bottom depicts the cumulative contributions to value added output growth in the mining sector. In short, this shows the balance between various elements that drive value in Australia’s mining sector at any one year – capital services (i.e. value derived from a producing asset), physical number of hours worked and multifactor productivity.

The result is an interesting picture of the impact of Australia’s recent ‘investment boom’ and the current transition out of it.

The graph shows that for the period of 1989/90 to present, the contribution from productive assets themselves (capital services measure) has been the predominant source of growth in gross value added, while there has only been a modest contribution from hours worked.

Falling MFP growth saw all of the productivity gains made since 1989-90 wiped out by 2007-08, when investment in new construction projects skyrocketed. The MFP decline continued until 2013-14 however has turned the corner since, posting positive MFP growth in both 2014-15 and 2015-16.

What does this mean for Australia’s resource industry in 2017?

Moving forward into 2016-17, AREEA’s principal adviser – economy and industry policy, Tristan Menalda, forecasts multifactor productivity in the mining sector to continue to grow due to:

- Accelerated tapering off of capital expenditure, particularly in the LNG sector.

- Export volume growth in the alumina, iron ore, metallurgical and thermal coal sectors.

- Mining organisations have significantly matured, advanced and streamlined operational processes since the downturn in commodity prices, and have learned how to do more with less.

Emerging risk: Ageing assets to curtail multi-factor productivity levels

There is an emerging risk that mining capital assets (i.e. those productive assets contributing the overwhelming majority of the industry’s value-add) are ageing and this will increasingly curtail mining productivity levels in the future.

According to ABS data released last week, total ‘mining’ capital expenditure in 2016 ended the year 29% down on prior year levels (or from $76.1bn in 2016 to $53.4bn in 2015). Looking forward into 2017, total mining capital expenditure is forecast to decline further, to the ~$40bn mark.

AREEA will continue to monitor and report on mining productivity levels, including through its quarterly publication the AREEA Resource Industry Market Outlook – next due to hit members’ desks in January 2017.

For any questions please contact AREEA’s Principal Adviser, Economic & Industry Policy, Tristan Menalda via [email protected].